MUCH WAS SAID at the CES technology show back in January about the teaming up of car companies and tech firms. Beyond one merely providing the infotainment systems, apps, and touchscreens for the other, foundations are seemingly being laid for deep-routed collaborations. Cars are, after all, inevitably turning into highly connected platforms as reliant on efficient and upgradeable software architecture as smartphones and laptops.

For technology companies this means the opportunity to build an entire automotive software stack, from the parking sensors and driver-assistance radar to the dashboard display and smartphone app. For carmakers, finding the right technology partner could mean simplifying a vehicle’s architecture and unlocking new revenue streams in the form of passenger entertainment and downloadable upgrades. Finding the wrong one could be equally impactful—just ask automakers who have had dealings with Apple.

Unearthing new customer experiences—and, of course, charging for them—is key to LG Electronics’ new technical collaboration with Magna, a major global automotive parts supplier that also assembles cars for companies like Mercedes-Benz, BMW, Jaguar, and Fisker.

LG says with Magna it will develop a proof of concept for an “automated driver infotainment solution” providing “differentiated customer experiences,” which means there will be several levels of optional tech in this infotainment package so it can potentially be sold to multiple auto manufacturers. Audi explored a similar concept back in 2019 with the Immersive In-Car Entertainment project that used sound, light, vibrating seats, and even the car’s active suspension to give passengers a “4D” movie theater experience.

Sony Honda Mobility (SHM) is another example of an auto-tech alliance gearing up to build the car of the future. The alliance used CES 2023 to show off the first vehicle under a new brand called Afeela. Sat among televisions and virtual-reality headsets on Sony’s stand, the concept car obligingly featured Fortnite and Spider-Man gameplay imagery on a digital display above its front bumper.

Although falling short of saying Afeela cars would include a PlayStation 5 to pacify road-trip boredom, SHM said it has started to “build new values and concepts for mobility” with Epic Games. Horizon Forbidden West, a PS5 game published by Sony, appeared on rear seat displays of the Afeela show car. Tesla, incidentally, recently added access to the Steam video game library to its newest cars.

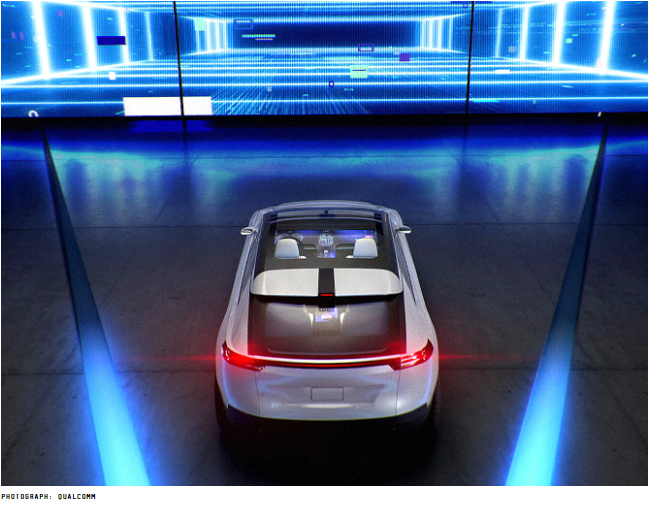

Unsurprisingly, it’s a key growth pillar for Qualcomm as the company’s revenue declines, as demand weakens for handsets and IoT products. Indeed, its automotive segment grew 58 percent in Q4 last year to $456 million—driven, according to Counterpoint, by the Digital Chassis.

Within Digital Chassis are four key Qualcomm automotive systems: These are called Snapdragon Auto Connectivity (connected systems like 5G and vehicle-to-vehicle technologies), Snapdragon Cockpit Platform (digital instrument clusters and infotainment), Snapdragon Car-to-Cloud (catering for over-the-air software updates), and Snapdragon Ride Platform (driver-assistance tech and autonomous driving capabilities).

“There is a tremendous amount of opportunity to reinvent the car,” says Nakul Duggal, Qualcomm’s senior vice president and general manager for automotive, “and a tremendous amount of that reinvention is happening because the car is becoming a truly digital product.”

Duggal says today’s automakers need to envisage “a tremendous number of use cases” that may present themselves over the lifetime of a vehicle, and that these “require you to really think about the platform very differently.”

By adopting Qualcomm’s Digital Chassis, Duggal claims car manufacturers will benefit from faster development of connected systems. “If you think about the way the car architecture is being designed going forward, you have centralization of compute capabilities, larger processors in the car, built-in connectivity, safety features built-in,” he says. “All of these require the car architecture to shift, and you need somebody who actually understands what it means to be able to build a platform.”

Most established auto marques are slow to adopt new tech, realize its significance, or sort hype from truly useful offerings when it comes to car systems. However, the uniformity and simplicity of electric drivetrains compared to internal combustion has helped level a playing field previously dominated by carmakers with more than a century of engine-building experience. Newcomers such as Chinese firm Nio hope that connected technologies and dashboard-mounted AI assistants will tempt new buyers away from more established brands, while BYD Auto, founded in 2003, made six of the top 10 EV models sold worldwide in Q4 last year.

Duggal says technology, software, and electrical architecture are among “the key differentiators” automakers will have to consider in a future where how a car drives no longer sets it apart from its rivals. “We have been working with every automaker for the past dozen years or so. We are clearly seeing trends that are common across what everybody needs. We include that in our platform, we provide a tremendous amount of software capability, integration capability—and that just allows automakers to move faster.”

To give you some indication of how popular Qualcomm’s automotive system is appearing to be, customers for its Digital Chassis include Sony Honda Mobility, Mercedes-Benz, General Motors, Cadillac, and Stellantis, a group that includes Peugeot, Fiat, Citroen, Jeep, Dodge, Maserati, and Chrysler among others. Qualcomm also says it has received support for the new platform from BMW, Hyundai Motor Group, Nio, and Volvo.

At a time when automakers are still struggling with semiconductor shortages, these manufacturers clearly hope to benefit from the supposed inherent simplicity offered by the Digital Chassis.

Duggal told WIRED how the platform drastically lowers the number of electronic control units (ECUs) used to form the “brain” of a car. “In the past, you would have a dozen different ECUs that were responsible for everything from displays to parking, to driver monitoring, to the audio and speakers,” says Duggal. “All of that is getting integrated into a common platform. We are now seeing next-generation EE architectures get reduced down to less than five main subsystems—cockpit for the in-car experience, telematics for in-car and cloud connectivity, driver assistance and automated driving systems, in-car networking, and zonal controllers being the main ones.”

The Digital Chassis also brings together a car’s various technology systems—including telematics, navigation, multimedia, EV charging, and autonomy—into an internet-connected platform.

Qualcomm has designed Digital Chassis to run on a set of system-on-chips (SoCs), and it can be customized based on the requirements of carmakers and their tier-one suppliers, with headroom for future upgrades delivered over-the-air. Ultimately, by bundling more systems onto fewer chips, the Digital Chassis supposedly intends to save car makers money.

Perhaps crucially, Qualcomm also says its Digital Chassis allows automakers to “own the in-vehicle experience … [and] extend their brand and bring engaging consumer interactions into the vehicle.” This will be particularly welcomed by manufacturers after the announcement in June last year of Apple’s next-gen multiscreen version of CarPlay, which will likely not be anywhere near as collaborative as Qualcomm’s offering. Indeed, when CarPlay 2 was announced, WIRED reached out to a number of major automakers for comment on the Cupertino system, only to find that it seemed as if the companies had no idea the news, and the potential impact to their dominance over their own car UIs, was coming.

The Digital Chassis system is designed to work across all regions and in all types of vehicle, and Qualcomm says it hopes the chassis will “inspire new business models for automakers” that go beyond merely selling and maintaining a car.

Aside from in-car gaming, these new business models will also include drivers being asked to pay to unlock features already installed in their vehicle. BMW caused controversy when it suggested heated seats already fitted to a car would require a subscription to function. Mercedes will soon ask drivers to pay $1,200 to unlock more performance, hidden behind a paywall written into their EV’s code. The latest model of Polestar 2 can be made more powerful by purchasing the Performance Pack, which arrives via a software update, no wrenches required.

As well as software and connectivity, technology companies can help automakers—especially startups—when it comes to mass production. Such a collaboration can be found with Fisker and Foxconn. The former is a Californian EV startup headed by former Aston Martin designer Henrik Fisker, and the latter is a Taiwanese company best known for assembling iPhones. The two plan to codevelop a circa-$30,000 EV due to go into production at a facility in Ohio in 2024.

Fisker said in 2021 that Foxconn will help with product development, sourcing, and manufacturing, and that the partnership will enable his company to deliver products “at a price point that truly opens up electric mobility to the mass market.”

Not wishing to put all of its automotive eggs in one basket, Foxconn is also involved in a joint venture with Chinese automotive giant Geely, parent of Volvo, Polestar, and Lotus among others. Similarly, Pegatron, another Taiwanese firm tasked with assembling iPhones, is now also a manufacturing partner of Tesla.

Finding a technology partner could soon be of utmost importance for car brands yet to fully embrace advanced infotainment, driver assistance, and connectivity systems. Lei Zhou, a partner at Deloitte Tohmatsu Consulting, told WIRED it is “highly likely” that automakers who go it alone with their own technology are in danger of being left behind.

Zhou added: “If conventional OEMs develop connected technologies with their current capabilities, they may find themselves left behind by emerging EV makers with IT backgrounds or OEMs that have partnered with powerful tech partners … significant value can be generated by collaboration with a variety of players, including technology and business fields.”

The opposite is also true, where technology companies keen to develop their first car require help from automakers with manufacturing experience.

Tyson Jominy, vice president of automotive consulting at JD Power, told WIRED: “Tesla, Rivian, Dyson, Lucid, and others have all done really well through the process of designing a car. But when you get down to the brass tacks of building a car it’s very difficult. When a lot of startups run into problems, it’s [because] mass-producing cars at scale is hard. So partnering up does make sense.”

Such partnering between auto and tech makes us wonder what Apple’s current position is. Its Project Titan division has ebbed and flowed for years now, reportedly growing, shrinking, and changing direction without ever revealing itself in public. CES this year showed how there are numerous ways for technology companies to break into automotive—so much so that it’s now easy to imagine Apple being unable to decide between running out an entire car, a major upgrade to CarPlay, an autonomous driving system, enhanced mapping, or a computational platform like the Qualcomm Digital Chassis.

If Apple is still interested in cars—and if Project Titan is even still active—we’re now starting to see precisely how its tech rivals are placing their bets. Going it alone would be tough, even for a company with Apple’s mighty resources.

“I just don’t think the nuts and bolts of building cars is something of interest to Apple,” says Jominy says. “So I could see something like a Sony-type play … Apple has one of the most envious positions in the auto industry [with CarPlay] … there’s more dollars to chase and it probably will, but the auto industry as a whole is still relatively low-margin, certainly relative to software.”

Whoever cuts the right deal with the strongest ally will secure the best position to succeed in what has become a rapidly evolving car industry—one that is now more reliant than ever on intelligent, connected technology (and entertainment, if autonomous driving ever becomes reality). Those who go it alone, or pick their partners poorly, run the risk of being left behind.

Source: wired | By: Alistair Charlton | March 18, 2023 | https://www.wired.com/story/electric-cars-qualcomm-apple/

To learn more, contact us today!

Roberto Baires